Climate finance plays a critical role in addressing the impacts of climate change, particularly in vulnerable countries like Nepal. The United Nations Framework Convention on Climate Change (UNFCCC), climate finance includes local, national and transnational funding from public, private and alternative sources that support mitigation and adaptation actions. However, this definition continues to face contradictions, with countries often interpreting climate finance as per their interests and benefits. Despite the contradiction, developing countries urgently need climate finance to address the climate impacts and fulfill global commitments.

The agreement at the UNFCCC COP29 held in Baku (November 2024) to mobilize US$300 billion per year by 2035 is a crucial milestone. This is expected to flow through established financial mechanisms such as the Green Climate Fund (GCF), Adaptation Fund (AF), Least Developed Countries Fund (LDCF), Special Climate Change Fund (SCCF), Global Environment Facility (GEF), and most recently are the Funds for Responding to Loss and Damage (FRLD) established in 2023.

Tracking climate finance ensures transparency, accountability, and effective allocation of resources for climate actions. It helps:

Effective tracking also helps in mobilizing additional funding, especially from private sources, ensuring that climate finance is used efficiently to address the urgent challenges of climate change.

The Organization for Economic Co-operation and Development (OECD) uses the Rio Markers to measure climate finance within its Creditor Reporting System (CRS). This system tracks financial flows under two categories:

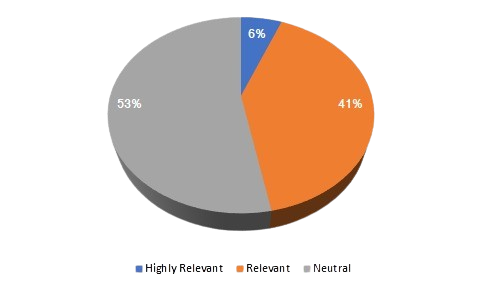

Projects are coded based on their climate relevance:

The OECD quantifies and reports financing for both mitigation and adaptation activities separately. This system provides transparency, helping track progress on climate finance commitments and ensuring clear reporting to international platforms like the UNFCCC. According to OECD, the overall thematic allocation of total climate finance provided and mobilized by developed countries has evolved over time with a progressive increase in funding for mitigation, adaptation, and cross-cutting initiatives.

Thematic analysis of climate finance shows a steady rise in adaptation’s share—from 17% in 2016 to 28% in 2022, driven by a USD 22.3 billion increase. Despite this, mitigation remained dominant in 2022, comprising 60% (USD 69.9 billion) of total finance, having grown by USD 27.7 billion since 2016. Cross-cutting finance also rose from USD 6.2 billion to USD 13.6 billion, maintaining a relatively stable 7–13% share. Climate Finance provided and mobilized in 2016-2022 per climate theme (USD billion)

Nepal has made commendable progress in tracking climate finance at the national and subnational levels. In 2017, the Government introduced the Climate Change Financing Framework (CCFF). Developed to mainstream climate finance into national planning and budgeting processes, the CCFF emphasizes:

Earlier in 2012, Nepal had brought into practice the Climate Change Budget Code Framework, which was integrated into the national budget for the fiscal year 2012/2013. The budget code classifies climate-relevant programmes as:

This distribution reflects progress in mainstreaming climate considerations into public finance but also highlights the need for increased direct climate investment.

| Province | (NPR in Billion) | |||

| Highly Relevant | Relevant | Total Relevant | Total Budget | |

| Koshi Province | 3.87 | 20.30 | 24.17 | 35.28 |

| Madhesh Province | 7.42 | 4.87 | 12.29 | 43.89 |

| Bagmati Province | 3.68 | 15.76 | 19.44 | 64.54 |

| Gandaki Province | 3.38 | 20.48 | 23.86 | 32.98 |

| Lumbini Province | 1.79 | 10.03 | 11.83 | 38.97 |

| Karnali Province | 4.49 | 12.52 | 17.01 | 31.41 |

| Sudurpashchim Province | 16.04 | 9.85 | 25.89 | 31.63 |

Prakriti Resources Centre (PRC) has been actively working to ensure increase access to and effective use of climate finance in Nepal. It supports national and local governments, civil society and communities in tracking and advocating for climate finance flows that are inclusive, transparent and responsive to local needs. Through research, policy dialogue, and capacity building, PRC aims to enhance the accountability and impact of climate finance, ensuring it contributes to resilience and sustainable development. It will continue to work with stakeholders at all levels to promote a just and effective climate finance system that responds to the needs of the people and the planet.